Transfers & Automatic Deposits

Riverfront offers several time-saving, convenient ways to transfer and deposit funds remotely to make managing your money easier.

Direct Deposit

Direct Deposit is a free service you can use to automatically deposit funds into a Riverfront checking or savings account. The funds are deposited automatically into your Riverfront account and you can access the funds on the day of deposit. Income received from your employer, Social Security, pension funds and U.S. government funds may all qualify for Direct Deposit. Ask if your employer or the company or agency that pays you offers Direct Deposit. If so, your payor may need you to complete a form and possibly provide them with a voided check to set up your Direct Deposit. You’ll also need the following information:

- Employer name or the depositor’s name and address

- Employee ID number or account number with depositor

- Riverfront account number (checking or savings) you want the money deposited into

- Riverfront ABA/Routing Transit Number (231385536)

Direct Deposit is easy and convenient and you won’t need to worry about checks getting lost, delayed, or stolen.

Ask if your employer or the company or agency who pays you offers Direct Deposit services. If so, your payor may need you to complete a form and possibly provide them with a voided check to set up your Direct Deposit.

Let the payor know which account you want your funds deposited into – either checking or savings, your Riverfront account number and Riverfront’s ABA/Routing Transit Number 231385536.

FedNow®

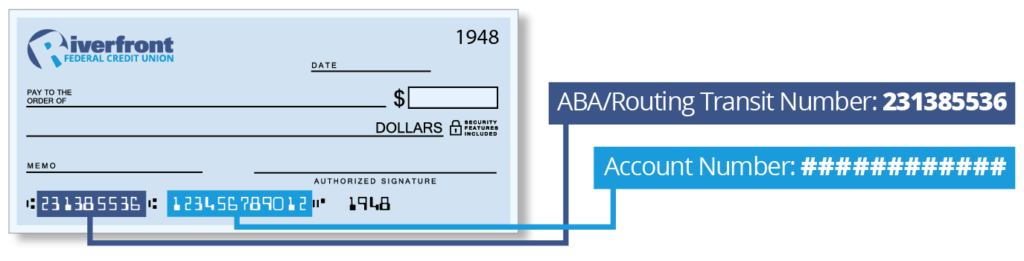

Receive funds safely and instantly to your Riverfront account from other individuals, businesses, government agencies, insurance companies and more with FedNow®, an instant payment service offered by the Federal Reserve. Instant payments are sent around the clock, every day of the year and are available within seconds, offering convenience and flexibility when another party is making payment to you that is time-sensitive. Simply provide the sender with Riverfront’s routing number (231385536) and the account number at the bottom of your Riverfront check. See example below.

To set up automatic payments from your Riverfront account, for example to setup a gym membership payment, the party you are paying will have a form for you to complete. You’ll need to provide the following information to that party:

- Riverfront Federal Credit Union’s ABA/Routing Transit Number 231385536

- Your Riverfront account number

- Specify the account you want the payment to be deducted from – savings or checking

Your employer may offer Payroll Deduction, where a portion of your paycheck could be deposited in to your Riverfront account.

Talk to your employer to see if they offer Payroll Deduction. If so, provide them with Riverfront’s ABA/Routing Number 231385536, your 6-digit Riverfront account number, then specify which account you want your funds deposited into, either checking or savings. Contact us if you want to further distribute your funds to any of your other Riverfront accounts, including loans. It’s that easy.

- Incoming

To wire funds to a Riverfront member account, please call us for assistance at 610-374-8351 or 800-451-3477. We will need to give you a specific account number. You will also need to provide the following instructions to the sender of the wire:- Receiving Institution: Vizo Financial Corporate Credit Union, Middletown, PA 17057, ABA/Routing Transit Number 231387550

- For Further Credit To: Riverfront Federal Credit Union. Please call us for this account number.

- For Final Credit To: Member Name on the Riverfront account, Member Account Number, then specify savings or checking

- Outgoing

Please call us for assistance 610-374-8351 or 800-451-3477.

Our external account transfer feature allows you to move funds between your Riverfront account and an account you own at a different financial institution. You can set up external transfers through online and mobile banking at any time. Fast, safe and easy, external transfers can be set up as either one-time or recurring transactions. Riverfront offers this functionality free to members, so why not save yourself a trip to the branch and try it today?

Benefits

- Safely and easily transfer funds between your accounts

- Transfer funds between accounts on the same business day if scheduled for that business day before the appropriate cutoff time or schedule to occur on a future business day

- Set up one-time or recurring payments from an account you may have at another financial institution to pay a loan you have at Riverfront

Eligibility

- Must be a Riverfront member aged 18 or older

- Must be enrolled in online banking for more than 30 days (only applies for outgoing external transfers)

- To enroll in Online Banking, click the “Sign on” tab above, then select “Enroll Now” for our online banking services

About External Transfers

- External transfers to and from your account can be processed as same business day transactions if the request is processed for the same business day prior to 2:00 pm.

- In the mobile app, same business day external transfers are available until 2:00 pm for incoming and outgoing transfers.

- At this time in Online Banking, same business day external transfers are only available for outgoing transfers (from RFCU to another institution) up to 2:00 pm. This will be expanded in a later software release.

- For incoming external transfers to share accounts and lines of credit, the funds are subject to a 3 business day hold.

Setting Up External Transfers in Online Banking

To add a new external account payee follow these steps:

1. Click on “Transfers & Payments” drop down button on the left-hand menu

2. Click on “Manage External Accounts”

3. Click “Add new payee” link on the page

Note: A transfer can only be done to/from accounts that you own at another financial institution.

4. To link the external account, enter the bank name, routing number, and account number in the “Link external account” box.

5. Select the type of account using the drop-down options which includes Savings and Checking.

Note: The primary name on account box is automatically filled in with the member’s name since the external account needs to be in the member’s name.

6. Click “Link Account”.

Note: Two small deposits will be posted to the other financial institution account either the same day (if scheduled before the 2pm cutoff time) or the next business day.

7. Access the activity on the external account to verify the amounts of the deposits to confirm the new payee account for the external transfer.

8. When you have the verification amounts click on “Confirm” under the payee name.

9. Enter the two separate deposit amounts as posted in the external financial institution account and click “Confirm”.

Note: If the amounts entered are correct, a message will appear that the “New external account has been confirmed.”

Note: This process is done for each new payee that is set up.

Making a transfer to an external account

Once the account has been confirmed, to make a transfer,

1. Click “Transfers & Payments” drop down button on the left hand menu,

2. Click “Make a Transfer”.

Note: The “Make a Transfer” page will appear which includes both the options to transfer to internal account and now includes the option to transfer from an external account or transfer to an external account.

3. Click the Riverfront account where the funds are coming from (i.e. Savings, Checking, etc.) under “Where is the money coming from?” section,

4. Click “An External Account” under the “Where is the money going?”

Note: A drop-down option will appear to select from any external transfer payee accounts that have been set up and confirmed previously.

5. In the “Transfer details” section, enter the amount to be transferred

6. Choose from either Scheduled transfer (one-time transfer) or Repeating transfer (recurring transfer).

7. Click “Schedule Transfer”.

Note: For a Scheduled transfer, the transfer can either be scheduled for the same day if scheduled before the 2pm cutoff time on a business day or can be set for a date in the future. Click on “Edit” next to the Scheduled transfer option to select the date.

Note: For a Repeating transfer, when selected, a pop-up box will appear. Enter the date that the transfer should start, choose the timeframe for repeating the transfer (Weekly, Monthly, Semimonthly, and Yearly), and choose when the repeating transfer should end (no end date, end after a certain number of occurrences, or end after a certain date). Click “Save”.

8. Click “Confirm Transfer”.

9. Read the Terms & Conditions,

10. Click the “I accept the terms and conditions” box to proceed with the transfer.

11. Click “Continue”.

Money Management Tools

Eight Simple Steps for Balancing Your Checkbook

Simplify the balancing process and reduce the anxiety when your bank statement comes.

Debt Reduction Strategies

Reduce your debt quickly and economically.

Seven Steps to Better Money Management

Manage your money more effectively with these tips.

Effective Strategies for Saving

Tips to establish and or grow your personal savings.

Ready to Get Started

Basic Checking is a free, no-frills, straightforward account that offers convenient services and no charges.

Open Your Account TodayVideo Banking – Easy and Convenient

During business hours, our team of experts is ready and waiting to work with you. When you log into your session, you can select which group can assist you from our Personal Member Service, Lending Services, Business Services or Mortgage Services area.

Reach Out